Core fUNCTION

The Ministry of Finance and Economic Development is entrusted with the stewardship of national resources, their mobilization, allocation, management and accounting for economic growth and development through the provision of sound macro-economic policies.

Our Vision

Sustained inclusive economic development and macroeconomic stability for an upper middle-income society by 2030

Our Mission

To formulate, coordinate, implement and monitor macroeconomic policies and national development strategies supported by effective mobilization and management of public resources for enhanced service delivery, sustainable inclusive economic growth and development.

Our Values

Transparency; Responsiveness ; Integrity; Professionalism; Accountability

Ministry'S mANDATE

OUR LEADERSHIP

The Ministry of Finance and Economic Development is headed by the Minister of Finance, whilst the second in command and administrative head and Accounting Officer is the Permanent Secretary.

Latest from our news room

ROUNDTABLE ON ZIMBABWE DEBT ARREARS CLEARANCE

TIME TO WALK WITH ZIMBABWE, AFRICAN DEVELOPMENT BANK PRESIDENT SAYS AT ROUNDTABLE ON ZIMBABWE'S DEBT ARREARS CLEARANCE

NATIONAL DEVELOPMENT STRATEGY 1

UPDATE ON THE DISSEMINATION OF THE NATIONAL DEVELOPMENT AGENDA

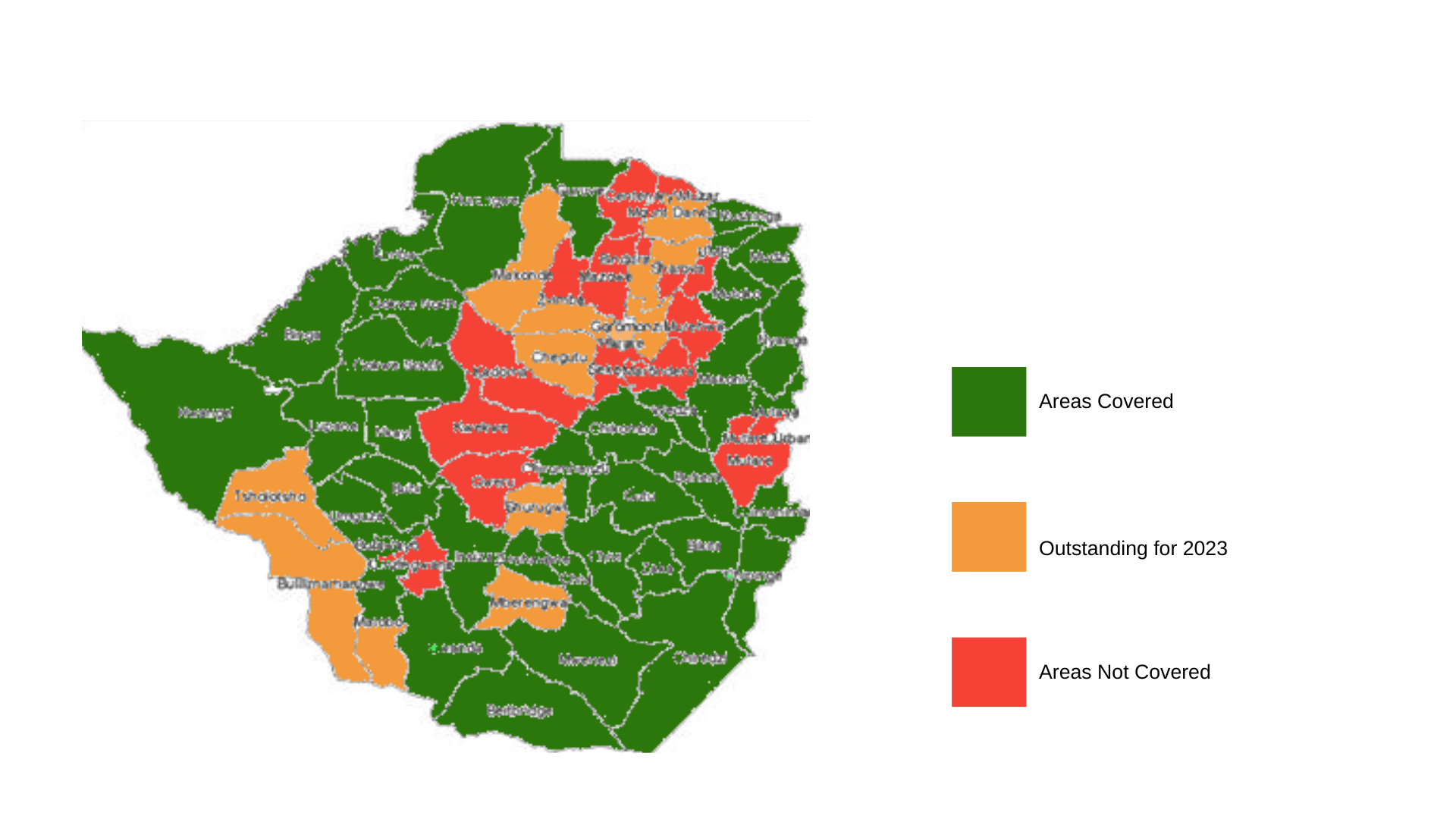

Following the launch of the National Development Strategy 1(NDS1)(2021 - 2025) by His Excellency, CDE. E.D. Mnangagwa in 2020, the Ministry embarked on an extensive dissemination programme across the country's Provinces. The Map above highlights the areas that have been covered as well as outstanding ones for the programme. The overarching objective is to have a shared understanding, build confidence and to enhance stakeholder participation and contribution towards the successful implementation of the development agenda.

vendor number requirements

Click the read more button for a detailed list of requirements for the application and Renewal of Vendor Number at the Ministry.

ZEDCON 2022 video

ZEDCON 2022 Elephant Hills, Victoria Falls

PUBLICATIONS

Get access to the Latest documents from our offices.

What Our Clients Say

Here are some of our stakeholder’s views from the 2021 stakeholder survey.